newfocus believes successful brands are salient in consumers’ minds, meet consumers’ needs and consistently and coherently communicate what the brands stand for across touchpoints. Growing brands build reach and engage with people across channels to bring short-term sales growth and build the brand in the long term. Brand benchmarking and tracking research can assist your organisation to make evidence based decisions to grow you brand and drive sustainable business growth by exploring:

- How strong is your brand?

- What does your brand stand for?

- How can you grow your brand?

The newfocus approach to brand benchmarking and tracking research delivers evidence based insights to help you make better and faster decisions about your brand.

Team industry experience

Our team brings together market and consumer insights from our vast experience of working with both global brands and local Australian marketers, across a wide range of industries.

The research team have extensive experience in brand health benchmarking and tracking research, both in Australia and overseas (Europe and Asia) so bring a rare combination of international experience and best practice, with strong local knowledge. Their backgrounds span a range of industries and roles beyond market research, including marketing and business development, meaning the insights they deliver are relevant and delivered effectively.

Ask us about our team’s expertise and experience and our innovative visual reporting approaches (admin@newfocus.com.au or call us on 1800 807 535).

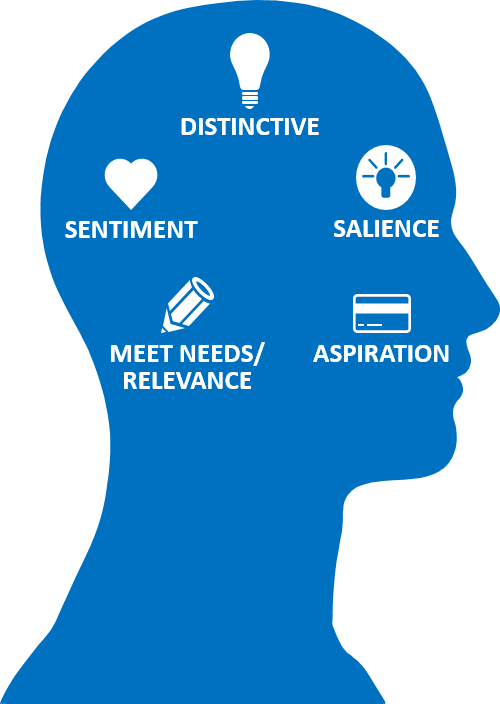

Our brand health evaluation and tracking model

We have developed a model that is applicable across most, if not all industries. Small projects or large, we offer a range of research solutions and tailor our research approach to meet the specific needs of our clients, on-time and to budget.

Our brand benchmarking and tracking model brings together essential brand metrics to provide the insights you need to define a winning strategy and help you grow your brand. It gives you clarity about where your brand is now and an early indication of where your brand is heading so you can plan and act quickly to seize opportunities and mitigate threats. Aside from the core brand health measurements (see below for more info), we also offer a flexible module, in which you can evaluate and optimise your advertising and communications campaigns (click here for more info).

How the model works

Our brand benchmarking and tracking model is tailored to your specific needs so you can manage and optimise your brand and marketing activities. Using a combination of innovative and traditional qualitative and quantitative approaches we can design a bespoke program to benchmark and track your brand health.

Core components of the model

The model covers a wide range of brand elements, with the core areas listed below. The model can be tailor made to your organisation’s needs.

- Brand Health Index Gives an indication of relative brand strength in the market, taking into account how cluttered that market is.

- The Impact of Brand Health on Purchase Intent and Advocacy Measures the purchase intent and advocacy levels as they are often lead indicators to future brand performance. Other variables such as brand favourability can also be tracked.

- Gap Analysis What’s important to customers, how competitors are perceived and where to focus your marketing investment are critical to understand.

- Brand Engagement Funnel Brand building activities aim to drive consumers through the consumer engagement funnel, from awareness and consideration to purchase and usage.

- Key Brand Positioning It is imperative to determine if the brand owns the desired positioning territory, and what to do if it doesn’t.

- Brand Personality The two models commonly applied are Brand Archetypes and the “Big Five” model.

Why use this model?

“If you can’t measure it, you can’t manage it”

- Provide a blue print to the board or senior management on where to focus your investment in the brand, and how to manage key components over time

- Engage your marketing partners on the brand building journey with clear and consistent understanding of the market needs and opportunities

- Provides an accurate diagnosis of where your brand is now, what’s important to your customers/stakeholders and the key gaps that need closing

- Includes robust brand health and campaign measurement metrics for continuous brand and campaign measurement

- A mixed-modal approach integrates different sources of data for comprehensive and actionable insights

- Reporting is designed and delivered based on the needs of your organisation to empower efficient and effective decision making with easy-to-use and actionable dashboards and visual reports with in-depth analysis when required

- Includes pragmatic advice and brand building learnings from leading consultants with a unique blend of local and global brand experience

Some of our clients

The team at newfocus has had extensive experience working with iconic global brands and successful local brands in brand health measurement research.

Case Studies

We have worked across the wide range of sector, below are some exemplified case studies:

Brand Communication Tracking

Background: To drive business growth, our client, a leading Australian food brand, has been activating various media activities for long-term brand building and brand engagement with Australian consumers. Hence, it is important that brand health research is conducted to assess ongoing brand health against competition and measure the effectiveness of advertising campaigns to optimise their contribution to building the brand.

Our approach: newfocus was commissioned to undertake brand health tracking research and we have crafted a flexible research design to meet the needs of tracking brand health and evaluating various advertising material throughout the year. The project consists of monthly online quantitative data collection with general population samples across Australia. A monthly dashboard has been provided to help our client monitor key brand metrics on a frequent basis and quarterly deep-dive analysis and reports have been generated to provide insights into campaign effectiveness and measure the progress of brand health and brand positioning.

Outcomes: The insights and fact-based findings from our research results has informed our client of necessary tweaks to their campaigns and given direction for future communication development.

Brand Health Tracking

Background: A large utilities provider in a non-competitive market needed to gain a better understanding of their brand health among the general population to inform it’s brand strategy and future marketing activities.

Our approach: The research consists of ongoing quantitative tracking of brand health metrics among the general state population. The methodology utilise random CATI data collection complemented by online panel sampling. This mixed modal approach allows for representative sampling against state-wide demographics. The unique challenge of measuring brand health in a non-competitive market required newfocus to adapt some brand health metrics (such as NPS) to provide a complete measure of brand health and positioning.

Outcomes: The outcomes of this research provides our client with ongoing results to keep track of brand health metrics and key KPIs, allowing for adjustments to brand strategy and marketing activities.

Brand benchmarking, segmentation and tracking

Background: A household appliance brand identified the need to strengthen it’s brand to improve it’s positioning in key market categories, with the overall aim of growing it’s customer base through increased awareness and consideration of the brand. A thorough exploration of the market was required to segment and identify key customer groups. An exploration of the brand’s positioning within the market was also needed to gauge brand awareness, usage and perceptions to benchmark it’s brand health.

Our approach: newfocus was engaged to conduct a thorough customer segmentation study, which was conducted quantitatively through a representative online study consisting of the general public and potential users of the relevant categories. A brand health benchmarking study was also conducted to provide a baseline measurement of the brand’s performance. This study also utilised an online survey approach. Following initial customer segmentation and brand benchmarking research, annual brand health tracking research has been conducted, consisting of online surveys with recent or potential category purchases. This online research has also been supplemented by qualitative ethnographic observations to provide more in-depth insights into the consumer purchase journey.

Outcomes: The research provided valuable insight into consumer segments to assist with targeted marketing strategies and product development, and the initial brand benchmarking research provided a baseline from which to measure brand health over time. Brand tracking has provided our client with insights into how their brand health is tracking against and an indicator into how marketing and product development strategies are performing.

Additional areas that may be relevant to your organisation

- Advertising tracking

- Brand positioning

- Innovation and product development studies

- Communication testing and tracking

- Product and packaging testing

- Buyer behaviour modelling

- Consumer and shopper trends

- Customer segmentation